Raising Kids Is Expensive—Here’s How Families Actually Survive It

The average annual cost of raising a child keeps rising every year, making it harder to stay afloat than it was for our parents. And yet, somehow, we are still expected to not only cover the basics, but also save for college, plan for retirement, and build enough wealth so our kids don’t start adulthood underwater.

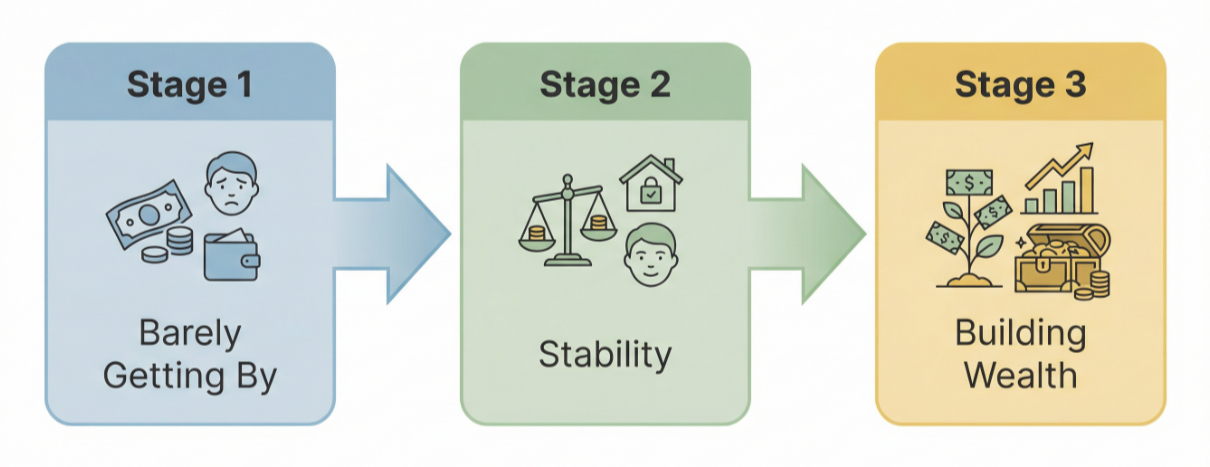

This blog is your starting point: how to move from barely surviving to building something real, even without a six-figure salary. Here’s your opportunity to go from paycheck-to-paycheck survival to family stability to generational wealth.

What you can learn:

How to improve your finances

Practical financial habits for middle-income families

Money tips for families who want to save more

How to build wealth on a moderate income

How to give your kids a financial head start

Stage 1: You’re Living Paycheck to Paycheck

When you’re barely getting by, every week becomes a math problem you didn’t sign up for: Which bill can wait? How do I make the groceries last? What happens if the car acts up again? In this stage, the goal isn’t building wealth. It isn’t even traditional “saving.” It’s day-to-day stability and making it to next payday without falling further behind.

That’s why one of the most-read posts on the site is Struggling with Grocery Costs? Here’s How to Keep Your Family Fed Without Going Broke, because so many parents are asking the same question: How do we survive the basics when life itself isn’t affordable?

Here’s what this blog helps you do in Stage 1:

Make the next grocery trip cheaper (check out the USDA food cost reports)

Avoid predatory “quick fixes” that trap families long-term

Stretch extremely tight budgets without slipping into scarcity panic

Use the safety nets available now, not someday

Build micro-habits that eventually support bigger financial progress

This is the stage where you learn how to stay afloat, without shame, without judgment, and without pretending that “just budget better” is a solution. You’re not the problem. The system is. And you deserve guidance that actually fits the reality of your life.

Check Out Posts Like:

Behavioral Finance: Why Your Brain Sucks at Money (And What to Do About It)

Money-Saving Tips for New Parents: From Hospital Bills to College Funds

Stage 2: You’re Not Drowning, But You’re Not Comfortable

Reaching stability means you can cover the basics, with maybe a little breathing room some months. But your financial life still feels fragile. One unexpected bill, one sick kid, one car repair, or one job hiccup can wipe out your progress and push you right back to the edge. This is the uncomfortable middle ground most families live in.

Most finance experts never talk about this stage because it doesn’t sell books or viral courses. “Get rich” sells. “Stop emergencies from ruining your life” does not. But this middle stage is where real financial change happens, and it’s exactly what this blog was built to support.

Here’s how this site helps you in Stage 2:

Build an emergency buffer (check out the Federal Reserve Board’s report)

Smooth out irregular income and unpredictable expenses

Create routines (not complicated budgets) that reduce financial stress

Learn the money “middle ground” no one teaches—stability

Make decisions that strengthen your future, not just survive the month

Stability isn’t glamorous, but it’s powerful. It’s the bridge between scarcity and wealth. The stage where families finally begin to feel grounded, capable, and hopeful again.

Check Out Posts Like:

The Psychology of Money: Why You’re Probably Screwing Yourself Without Even Knowing It

They Never Taught Us This: Money Terms Every Parent Should Know

What You Should Know About Compound Interest vs. Simple Interest

Stage 3: You’re Financially Steady Enough to Grow

Most parents arrive in this stage still feeling “behind” compared to what society says wealth should look like. You might not have the dream house or the yearly vacation, but you are finally past pure survival mode and ready to think about how your choices today can change your child’s financial future.

Once you’re ready to build more than stability, this blog walks you through exactly how ordinary families create real assets on ordinary incomes. Wealth isn’t about luck or a six-figure salary. It’s about strategy, consistency, and a long game that most parents are never taught.

Here’s how this blog supports you in Stage 3:

How small, consistent contributions beat “big gestures”

How to fully fund a college education over time

How to set your child up with a down payment before they’re 18

How to start investing (check out the SEC’s investing basics)

How to model healthy financial habits your kids will copy

Why wealth is built slowly, and why that’s good

In this stage, wealth stops being a fantasy and starts becoming security, options, and a young adult who steps into the world unburdened instead of weighed down.

Check Out Posts Like:

How to Create Generational Wealth: Custodial Brokerage Account Edition

How to Create Generational Wealth: Roth IRA Edition (with Cold, Hard Numbers)

Why 529 Plans Aren’t a Waste, Even If Your Kid Skips College

What This Blog Promises You Going Forward

This isn’t a finance site pretending you can “manifest” your way out of poverty. And it’s not one of those grind-till-you-cry hustle blogs either.

Here, money advice is:

Practical (because parents don’t have time for nonsense)

Empathetic (because your financial life is emotional, not just numerical)

Stage-based (because every family starts somewhere different)

Realistic (because we’re raising kids in a system not designed for us)

Focused on stability first (because without stability, nothing else sticks)

Wherever you fall—surviving… stabilizing… or building wealth—there’s a path forward, and it doesn’t require perfection, guilt, or a six-figure salary. Just small steps, taken consistently, toward a more secure future for your family.